Takeaways from the Professional Accountants in Business Advisory Group's Meeting

In the dynamic landscape of today's global business environment, professional accountants in business (PAIBs) are not only sought after but are actively leading and transforming organizations across industries and regions. The demand for these professionals has surged, driven by the recognition that individuals with a comprehensive grasp of both business operations and a robust finance and accounting foundation play pivotal roles in steering organizations through challenges and opportunities. As businesses grapple with uncertainties in the economic environment, geopolitical shifts, and navigate the complexities of digital transformations, sustainability, and climate transitions, effective business partners equipped with the unique skill set of PAIBs are indispensable. In this context, the role of professional accountants extends beyond traditional financial responsibilities, positioning them as key leaders shaping the trajectory of organizational success.

IFAC’s PAIB Advisory Group met recently in Paris and over an engaging two days, acknowledged how PAIBs are leading and driving sustainability and digital transformation agendas including an investor perspective on sustainability information needs, as well as how PAIBs are essential to ensuring the success of sustainability reporting standards and requirements. The group also considered how artificial intelligence (AI) and intelligent automation (IA) are disrupting business and elevating the work of accounting and finance professionals. Other topics covered on the agenda included the influential role of CFOs in private equity funded companies, updates on corporate governance, and enhancing the attractiveness of the profession.

Three key takeaways emerged from the meeting, underscoring the global accountancy profession’s efforts to elevate the contribution of PAIBs to organizational performance and success.

1. The accountancy profession is driving higher-quality, decision-useful sustainability-related information

To advance the global transition to a sustainable economy, companies and the financial markets need decision-useful sustainability information. Increasing the quality of, and trust in, this information is crucial, and the accountancy profession is stepping up its role.

There is increasing demand for high-quality decision-useful sustainability-related information. Companies need this information to inform key strategic decisions aimed at achieving business and sustainability objectives. Externally, such information is critical for the asset management community, who are key in enabling the financial markets to allocate capital to businesses and projects that are driving sustainability agendas.

An Asset Management Perspective on Sustainability Information Needs

Cathrine de Coninck Lopez, Global Head of Responsible Investment, HSBC Asset Management shared HSBC’s approach to developing sustainable investment solutions and repositioning traditional core investment approaches towards sustainability. Credibility in sustainability-related information and disclosures is important, particularly given the significant amounts of capital being aligned to achieving sustainability outcomes in the capital markets. Asset managers are looking to the accountancy profession to help drive higher-quality decision-useful sustainability-related information related to material sustainability risks and opportunities.

It is essential that companies understand the information needs of asset managers and owners, and how they use sustainability-related information in decision making. Where a company’s stock is being held and the sustainable product offerings and funds it is invested in will determine the information sought from company disclosures, as well as from external third-party sources.

However, the lack of consistency and comparability in corporate disclosures on sustainability, and a lack of assurance has resulted in low levels of confidence in the information, creating challenges and uncertainty for investors.

Developments in sustainability reporting globally provide an important opportunity to address inconsistent and unreliable disclosures. The adoption of IFRS Sustainability Disclosure Standards should provide a global baseline of consistency for investors. Jurisdictional requirements need to build on and enhance these global standards to ensure greater consistency that supports global capital flows. Global harmonization of sustainability-related disclosure should also help to reduce the current significant costs to asset owners, managers, and companies, of collecting, analyzing, and reporting data.

Global Developments in Sustainability Reporting: A Priority for the Accountancy Profession

The PAIB Advisory Group discussed:

- IFAC’s sustainability work program and four key priorities for the accountancy profession.

- The scope of the European Union’s sustainability legislation in the context of the EU’s Sustainable Finance Framework, and the key features of its reporting requirements within the Corporate Sustainability Reporting Directive (CSRD) and European Sustainability Reporting Standards (ESRS).

- The US Securities and Exchange Commission’s (SEC’s) proposal to enhance and standardize climate-related disclosures in the US.

READ MORE:Developments in Global Sustainability Reporting: A Priority for the Accountancy Profession

While sustainability reporting is crucial, sustainability starts inside companies. PAIBs play key roles in driving sustainability strategies, particularly by enhancing the connectivity of sustainability and financial information to drive sustainability priorities and resource allocation. To highlight the contribution of the finance function, Michael Mills, Finance Director of Strategy and Sustainability at Jaguar Land Rover (JLR) Automotive PLC shared insights on the dynamic intersection of finance and sustainability within JLR. He highlighted the vital role of the finance function in driving JLR’s sustainability agenda by:

-

Incorporating sustainability into business planning and financial targets, linking cost and quality targets with sustainability targets.

-

Leveraging green finance opportunities to enable investment in sustainability initiatives including renewable energy.

-

Driving best practices in diversity, equity & inclusion within the finance team and across the organization.

-

Going beyond compliance requirements for external disclosures, integrating and enhancing sustainability reporting across the Tata group leveraging JLR’s experience.

-

Building ESG reporting and compliance into internal audit schedules to hold the business to account.

READ MORE: Case Study: Connecting Finance and Sustainability at Jaguar Land Rover (JLR) Automotive PLC | IFAC

Image

Board oversight of sustainability

The revised G20/OECD Principles of Corporate Governance (the Principles) include a new chapter on sustainability and resilience, covering three major elements:

- the disclosure of sustainability related information.

- the responsibilities of the Board on sustainability matters.

- the dialogue between a company and its shareholders and stakeholders on sustainability.

Focusing on this new chapter, IFAC, ecoDa and Business at OECD (BIAC) convened global experts to discuss the main features of the revised Principles, the heightened expectations on boards and the implications for non-executive directors’ accountability, including legal liability. A summary and recording of the event is available here: Strengthening Long Term Value Creation: Global Experts Insights on Revised Corporate Governance Principles | IFAC

The quality of sustainability-related information for decision making and reporting should improve with:

- the involvement of professional accountants within companies preparing and analyzing information and implementing processes and systems to enhance data collection and measurement

- increasing scope and levels of independent external assurance; and

- effective board oversight.

Companies are seeking to recruit accounting and finance professionals with deep sustainability knowledge. Professional accountancy organizations (PAOs) need to be key partners in fostering skills and capacity to meet the evolving demands of sustainable business practices.

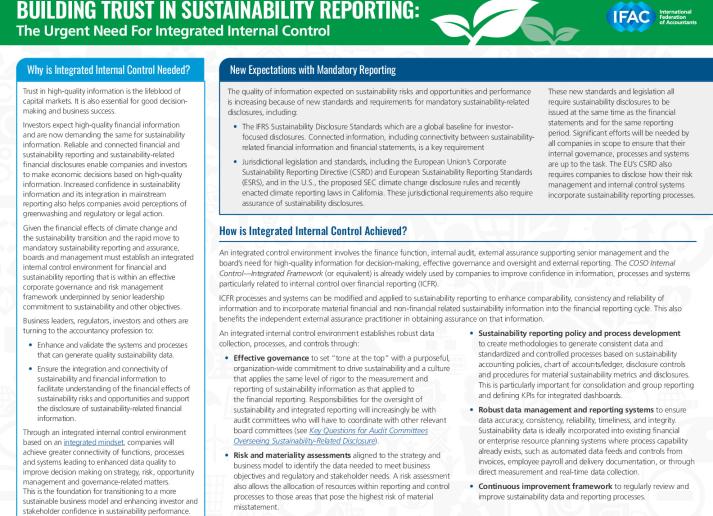

Building Trust in Sustainability Reporting: The Urgent Need for Integrated Internal Control

Through an integrated internal control environment based on an integrated mindset, companies will achieve greater connectivity of functions, processes and systems leading to enhanced data quality to improve decision making on strategy, risk, opportunity management and governance-related matters.

2. Finance leaders are harnessing artificial intelligence (AI) and intelligent automation (IA) to disrupt business and change the future work of finance and accounting professionals for good

Finance leaders who embrace AI and IA are transforming businesses and the nature of work, which impacts the roles and responsibilities of finance and accounting professionals. PAIBs are harnessing the power of AI and automation to optimize processes and workflows and provide meaningful data for decision making.

Companies globally are investing heavily in AI and IA to simplify and automate repetitive rules-based tasks, streamline work practices, optimize end-to-end processes, and provide meaningful data and insights. AI provides enormous potential to enhance productivity and efficiency with use cases in all functions including finance, procurement and supply chain, marketing, HR, product development/design, risk management, manufacturing and operations, and customer-facing teams and sales.

With routine tasks automated, accounting and finance professionals can shift their focus towards strategic activities such as financial planning, analysis, and advising, contributing to the overall growth and success of the organization. Generative AI also provides enormous opportunities to enhance productivity.

Analytical & Gen AI

Unlike “traditional” AI that automates repetitive tasks and performs specific tasks intelligently based on a specific dataset (via pattern recognition), Gen AI assists in language-based tasks and creating content (text, images, music, computer code etc) – “pattern creation”

Analytical

- Classification – categorize input data into categories based on predetermined variables

- Prediction – Predict future events or outcomes based on historical data

- Optimization, trends/driver analysis, anomaly detection

Gen AI/ Large Language Models (LLMs)

- Summarization/synthesis – generates summary of large volumes of text or other media

- Generation of content and translation

- Communication between a user and computer system

- Knowledge management – highlights info and insights embedded into all data types (docs, emails etc.)

Image

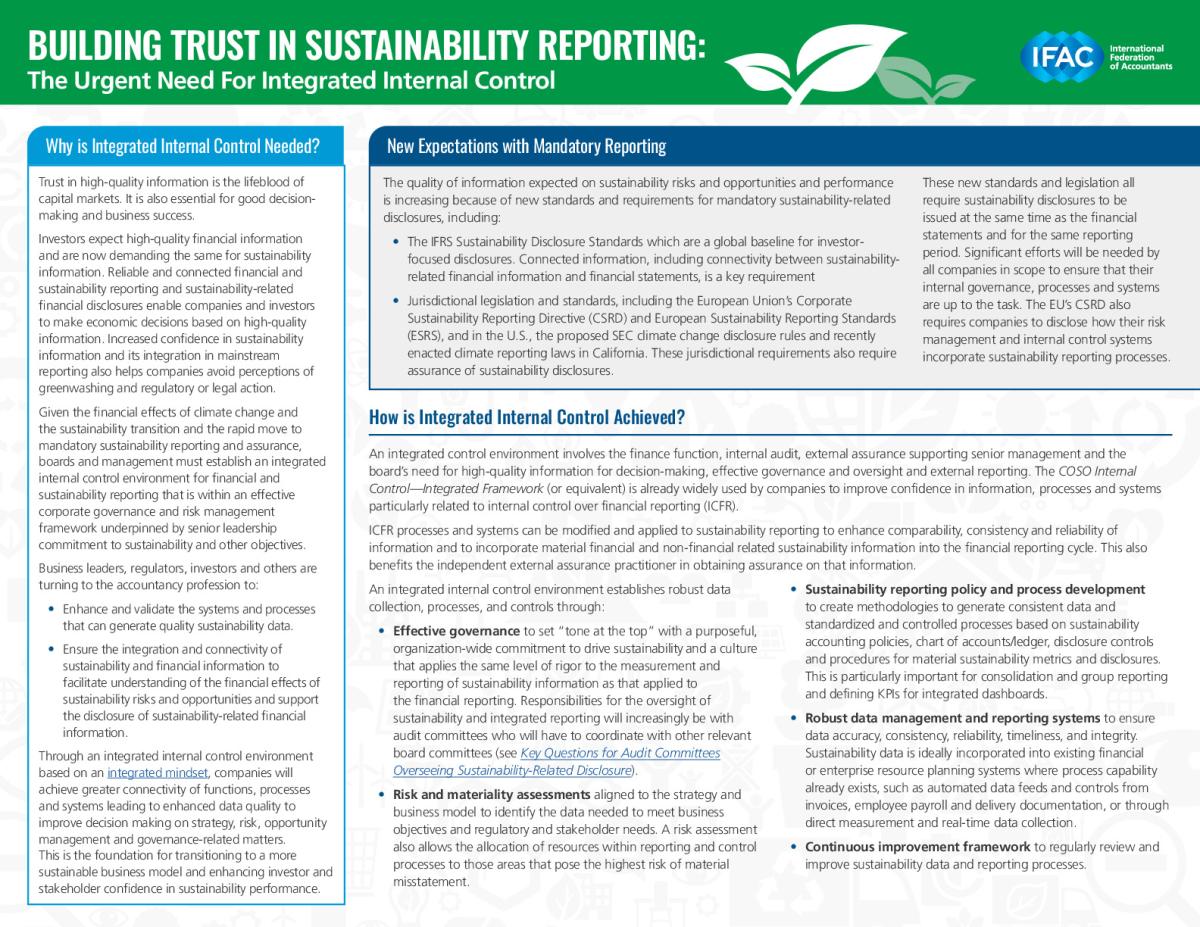

AI & Intelligent Automation – Disrupting Business; Elevating the Work of Accounting & Finance Professionals

Pascal Bornet, CPA and former AI and automation leader at EY and McKinsey presented to the PAIB Advisory Group on the opportunities that AI and intelligent automation provide to work better, augment human decision-making and increase job satisfaction.

Pascal highlighted five critical success factors for scaling intelligent automation:

- People at the center: People are at the core of change management and education efforts.

- Management support and involvement: Leaders actively facilitate and are involved in transformation.

- Combining intelligent automation capabilities: Synergize and prioritize capabilities effectively.

- Democratizing access: Intelligent automation is accessible to all and empowers all staff to automate work practices without advanced coding skills.

- Leveraging technology: Utilize technology to accelerate intelligent automation implementation to improve the scope, scale, and speed of automation.

The full recording of Pascal’s presentation is available on the IFAC website: AI & Intelligent Automation – Disrupting Business; Elevating the Work of Accounting & Finance Professionals | IFAC

3. Forward-Thinking Leadership: Strategies for Nurturing Future Leaders

There is strong demand for professional accountants, alongside a global shortage, intense competition for talent, and challenges in retaining talented professionals. In response, the accountancy profession needs to address the commonly narrow perception of what accountants do, better promote the opportunities, diverse career pathways and leadership opportunities for accountants in business and adapt education and training to meet the evolving needs of employers. This concerted effort is essential to nurture a new generation of accountants who can confidently step into leadership roles, steering organizations towards success in a rapidly changing landscape.

To enhance the attractiveness of careers as PAIBs, it is important to position accountants as finance and business leaders. The profession can open many doors and rewarding career pathways in business, such as

- Co-pilots – finance business partners and collaborators at the heart of decision making,

- Directors who deliver trust and confidence in the governance and leadership of organizations and drive the right conversations to ensure business resilience; and

- Technical experts (accounting, finance, risk, tax etc.) and specialists in new areas of opportunity and risk (digital and AI, cyber security, data analysis).

CFOs creating and protecting value in private equity funded organizations

To highlight the opportunities for finance and accounting professionals in the private equity (PE) environment, the PAIB Advisory Group convened a panel of PE-funded company CFOs. Sanjay Rughani, PAIB Advisory Group Chair, moderated the discussion between

- Dado Alonso Sanchez, Group CFO, BBG

- Murat Çağlar, CFO, Sanovel

- Edward Guest, COO/CFO, Unlimited

Image

Key messages:

- PE funded organizations provide unique opportunities for finance and accounting professionals to work in dynamic, fast paced and rapidly growing businesses that are often transforming industries.

- The CFO is a critical and highly valued central figure in a PE funded company because they play an important strategic role in helping the business to transform, grow, and create value for key stakeholders to maximize valuation for an eventual sale.

- CFOs must manage internal conflicts, balancing the interests of the business with the interests of the funders. These are often aligned, but there could be potential conflicts, for example a push for a short-term strategy that maximizes exit value.

- Key skills/competencies needed include stakeholder and relationship management, leadership and influencing, talent management, communication, and technical (many KPIs will be financial).

- Exposure to the PE world can provide useful experience for finance professionals. It demands dedication with a steep and intense learning curve, but for those who choose a career in a PE-funded company the benefits include

- Peer learning in a collaborative, energizing environment

- Good compensation tied to exit performance

- Opportunity to help run a business and grow in leadership

- Continuously acquiring new skills and knowledge beyond finance

- Contributing to value creation and value protection, and ensuring sustainable growth and long-term integrity of the business

- Creating lasting networks and relationships.

Emphasizing the key capabilities and skills that professional accountants have and can apply in the context of evolving business trends and needs, is also essential. Accountancy can provide a route to acquiring much needed capabilities and skills sought by businesses, which include:

- Professional & technical skills relevant to new areas such as sustainability and digital transformations, which are now being incorporated into accountancy education and training.

- Leadership and human (how we use what we know) – including critical thinking, communication, collaboration, and creativity as the basis of driving transformation and success.

Preparing future ready PAIBs – Transformational Leadership for Transformational Times

Ash Noah, VP & Managing Director Learning Education & Development, AICPA CIMA shared insights on how professional accountancy education and training can be transformed by simulation and case study-based methods in response to digital and sustainability transitions. He highlighted:

- The need for many professional accountants to develop twenty-first century skills to transition into co-pilots steering organizations to success and resilience, including customer-oriented leadership, collaboration, communication, and critical thinking. The profession must earn its involvement in sustainability and digital transformations.

- The changing nature of evaluating performance including both societal impact and shareholder returns, and the need to develop relationships across organizations and key stakeholders.

- Positioning PAIBs to lead with purpose beyond financial objectives, executing strategy, managing risks and opportunities, creating culture, enabling governance to support decision-making and providing relevant information to drive business performance.

- The importance of providing future professionals with experiential learning, hands-on experience and the role of technology in facilitating delivery.

- The need to shift from traditional memorization-based testing to testing the application of knowledge.

- To respond these trends and requirements, the new AICPA-CIMA study platform is designed to prepare professionals through real-life case studies at different levels and equip them with real-world and human skills.

- The importance of a mix of education and having the right mentors for professional growth, as well as the importance of on-the-job learning and continuing professional development (CPD), highlighting that technical training typically dominates professional development rather than wider strategic and behavioral upskilling.

- AICPA-CIMA CPD is output-based and linked to employer activity, allowing for experience-based learning. Their CPD approach is more practical and development-oriented rather than focused on a specific number of hours.

The accountancy profession needs to rethink professional education and what is required to fulfil the changing mandate and role of the CFO’s office, by delivering more innovative education and training that better prepares PAIBs for leadership roles in sustainability and digital transformations.

The skillset and expertise of professional accountants positions them well to lead and transform organizations and elevate the profession globally. By driving decision-useful sustainability information, harnessing disruptive technologies like AI and IA for good, and promoting the profession's wide breadth of career pathways, professional accountants can seize the uncertainty of the current environment to elevate the profession and society at large.

To be sure not to miss our learnings, follow IFAC on LinkedIn and subscribe to the mailing list for updates.